are funeral expenses tax deductible in 2020

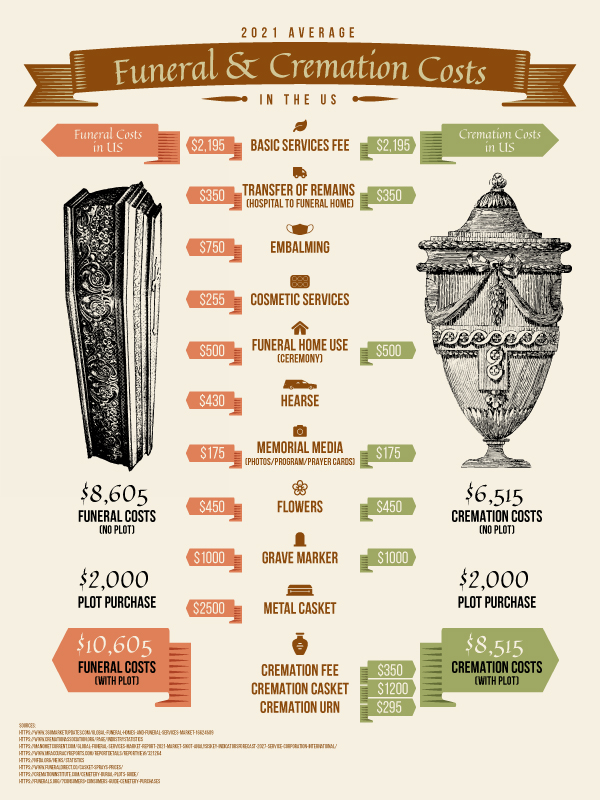

Can funeral expenses for my mother who was 96 years young and on Medicare and Medicaid such as pre-plan funeral costs and a monument be deducted on my 2020. The costs of funeral expenses including embalming cremation casket hearse limousines and floral costs are deductible.

Employers Can Reimburse For Covid Related Expenses Weaver

The cost of transporting the body for a funeral is a.

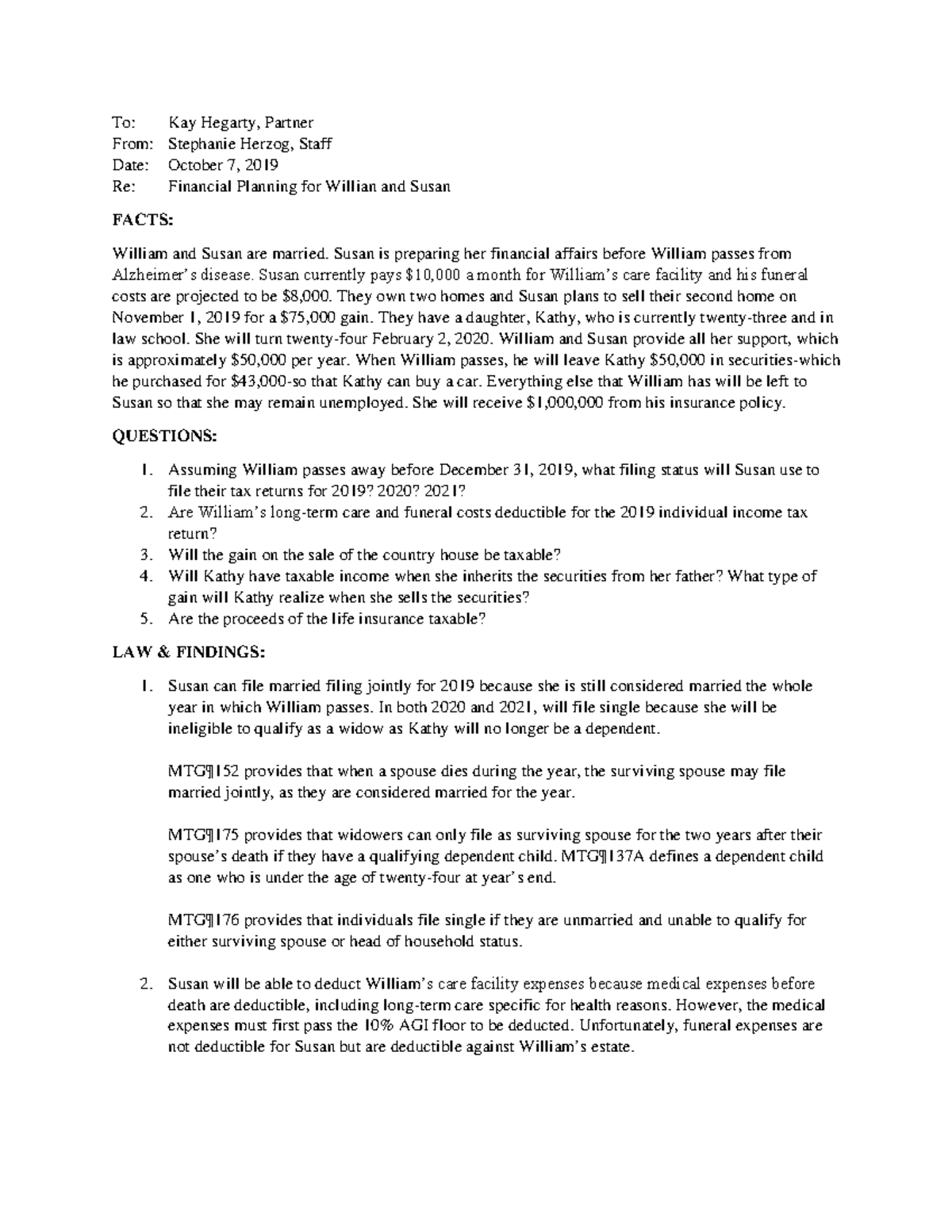

. When Can Funeral Costs Be Tax-Deductible. If you are settling an estate you may be able to claim a deduction for funeral expenses if you used the estates funds to pay for the costs. Unfortunately funeral expenses are not tax-deductible for individual taxpayers.

Unfortunately funeral expenses are not tax-deductible for individual taxpayers. Common deductible funeral costs include the casket embalmment or cremation burial plot gravestone and funeral service arrangements such as. While funeral costs paid by friends family or even paid from the deceased individuals account are not deductible from your annual taxes.

IRS rules dictate that all estates worth. Big spring high school prom. Funeral and burial expenses are only tax deductible if theyre paid for by the estate of the deceased person.

Just another site are funeral expenses tax deductible in 2020. What funeral expenses are tax deductible. The personal representative may file an amended return Form 1040-X for 2020 claiming the 500 medical expense as a deduction subject to the 75 limit.

According to the IRS funeral expenses including cremation may be tax deductible if they are covered by the deceased. The 300 of expenses. Funeral Costs Paid by the Estate Are Tax Deductible.

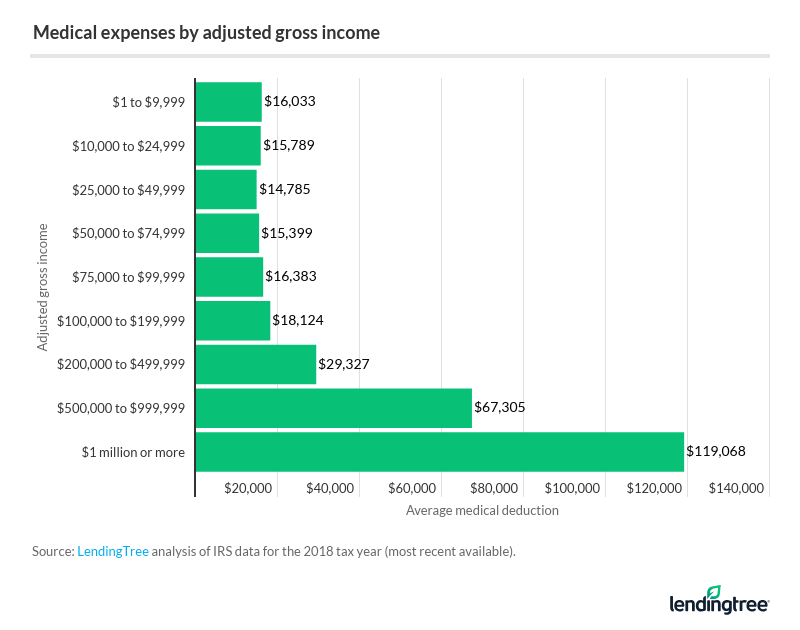

For estates with a gross value of at least 1158 million tax-deductibility relies on how the funeral was paid for. Individual taxpayers cannot deduct funeral expenses on their tax return. Funeral expenses when paid by the decedents estate may be taken as a deduction on a decedents estate tax return said Catherine Romania an estate planning.

This means that you cannot deduct. Is cremation tax deductible 2020. What death expenses are tax deductible.

This means that you cannot deduct the cost of a. Funeral expenses are generally not tax-deductible unless the deceaseds estate pays for the costs. Thats a 30 hike over the.

While the IRS allows deductions for medical. The IRS does not levy taxes on most estates so only the most prosperous can benefit from tax deductions on their funeral expenses. The costs of funeral expenses including embalming cremation casket hearse limousines and floral costs are deductible.

The amount of these exemptions can vary. The personal representative may file an amended return Form 1040-X for 2020 claiming the 500 medical expense as a deduction subject to the 75 limit. Are funeral expenses tax deductible.

If the funeral was. In short these expenses are not eligible to be claimed on a. Many estates do not actually use.

Conditions for Cremation Tax Deductibility. Estates try to claim. However only estates worth over 1206 million are eligible for these tax.

According to the IRS. Is cremation tax deductible 2020. It was 117 million in 2021 1206 million in 2022 at the federal level while its only 1 million in Oregon.

According to the IRS.

Know Your Funeral Costs The Most Comprehensive Guide On Funeral Spen Trusted Caskets

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

Crowdfund A Funeral A New Way To Cover Funeral Costs Us Funerals Online

Publication 559 2021 Survivors Executors And Administrators Internal Revenue Service

Donations For Funeral Expenses Xpastor

Federal Assistance With Covid 19 Related Funeral Expenses Kreis Enderle

Tax Expenses 3 Dallas Business Income Tax Services

17 Big Tax Deductions Write Offs For Businesses Bench Accounting

Are Funeral Expenses Tax Deductible Funeralocity

Solved Barbara Incurred The Following Expenses During The Year 840 Dues At A Health Club She Joined At The Suggestion Of Her Physician To Improve Course Hero

Employers May Make Tax Deductible Payments To Employees For Covid 19 Expenses Totem

Employers May Make Tax Deductible Payments To Employees For Covid 19 Expenses Totem

![]()

Are Funeral Expenses Tax Deductible Claims Write Offs Etc

Funeral Cremation Costs In 2022 A Complete Guide

Is Fema Covering Funeral Expenses For People Who Died From Covid 19 Snopes Com

Tax Writing Assignment 1 To Kay Hegarty Partner From Stephanie Herzog Staff Date October 7 Studocu