estate tax changes build back better

This analysis was updated to contain the November 4th amended changes to the cap on the state and local tax SALT deduction. The Build Back Better Act was passed by the House of Representatives on November 5 2021 and is headed for the Senate.

Us Failure To Pass Build Back Better Act Imperils Rights Human Rights Watch

In its then-current form the legislation would have had drastic impacts on transfer taxes grantor trust rules and income taxes.

. The amended change would raise the cap to 80000 from 2021-2030 and revert back to 10000 for 2031. Notable aspects of the Biden framework for the Build Back Better Act that will affect estate planning include. Heres what you need to know.

Last month we sent a Client Alert about the Build Back Better Act the Proposed Act which contains tax law changes that would negatively impact numerous estate planning initiatives. On September 13 2021 the House Ways and Means Committee released a proposed tax bill House proposal as part of the Biden administrations Build Back Better Act. The House Ways and Means Committee recently released its plan to pay for President Bidens proposed Build Back Better Act.

The prior version of the Build Back Better bill made substantial and far-reaching changes to the taxation of grantor trusts and transactions between the grantor and the trust which would have virtually eliminated the use of grantor trusts as an estate planning tool. 164 b limitation on the deduction for state and local taxes from. First the current USD117-million estate and gift tax exclusion was provided under a temporary clause of the Tax Cut and Jobs Act of 2017 and will be halved on 1 January 2026 even without any act of congress through the sunset provisions that remain in place.

Many of the changes to the Internal Revenue Code proposed by that plan would directly impact gift and estate tax planning. The segments of the proposed bill discussed below highlight important changes to the way. Lets get probate off your shoulders.

Ad ClearEstate Can Save estate executors up to 120 hours and 8500 in fees. November 5 2021. While the Build Back Better Act provides a temporary reprieve for those with assets.

This preliminary analysis is still available here. None of the major provisions that would have affected estate planning were included in the House version. 3 version introduced an increase to the cap with a slightly higher increase in the Nov.

115-97 increase the limits on certain discounts of value for. The revised version of the bill is silent regarding grantor trusts. Three versions of the Build Back Better Act have attempted to make significant changes to current gift estate and trust income tax law.

As initially proposed the Act would have reduced the current 117 million basic exclusion amount BEA to approximately 6 million on January 1. Day Pitney Generations Newsletter. The bill would increase the Sec.

Earlier this fall we sent out an advisory regarding the estate tax planning implications of the proposed Build Back Better Act the Act which had been introduced in the House of Representatives. Tax Changes for Estates and Trusts in the Build Back Better Act BBBA The Build Back Better Act BBBA. 2022 Updates to Estate and Gift Taxes.

Two recent pieces of legislation the Infrastructure Investment and Jobs Act IIJA and the Build Back Better BBB bill were expected to include provisions changing the. These proposals are currently under consideration by the U. While the plan is still in negotiations and changes to the legislation are likely many of the.

It would eliminate the temporary increase in exemptions enacted in the Tax Cuts and Jobs Act TCJA. Tax provisions in the Build Back Better act Extending expanded earned income tax credit. 5376 would revise the estate and gift tax and treatment of trusts.

Prior versions of the Build Back Better Act didnt contain a modification to the 10000 cap but the Nov. The BBBA proposal seeks to reduce these exemptions from its current 117 million per individual to 5 million indexed for inflation. Build Back Better Act and What the Changes to Gift and Estate Taxes Could Mean for Your Family Business.

The Proposed Act includes a couple of proposals that would eliminate many of the benefits of irrevocable grantor trusts ie an irrevocable trust where the grantor. December 3 2021. Download our free Probate Checklist.

Proposed Federal Tax Law Changes Affecting Estate Planning. The bill would extend the changes to the earned income tax credit that were. Surtax of 5 on the modified adjusted gross income of a trust or estate above 200000 Additional 3 surtax on the modified adjusted gross.

The House Ways and Means Committee recently released its plan to pay for President Bidens proposed Build Back Better Act. Estate and Gift Tax Exemptions The Biden framework does not include lowering the current estate gift and generation skipping transfer GST tax exemptions before the previously scheduled sunset date of December 31 2025. President Bidens proposed Build Back Better Act includes major changes to estate and gift taxes to fund the social and education spending plan.

While the plan is still in negotiations and changes. Gift and Estate Taxes Proposed Under the Build Back Better Act Lowering the gift and estate tax exemptions seems a lock. Estate gift and GST tax.

The House Ways and Means Committee recently released a draft of the tax changes proposed as part of the budget reconciliation bill to implement President Bidens social and. SIGNIFICANT ESTATE GIFT AND INCOME TAX CHANGES PROPOSED UNDER THE BUILD BACK BETTER ACT.

The Monthly Child Tax Credit Payments Are Done Here S What Will Replace It Fortune

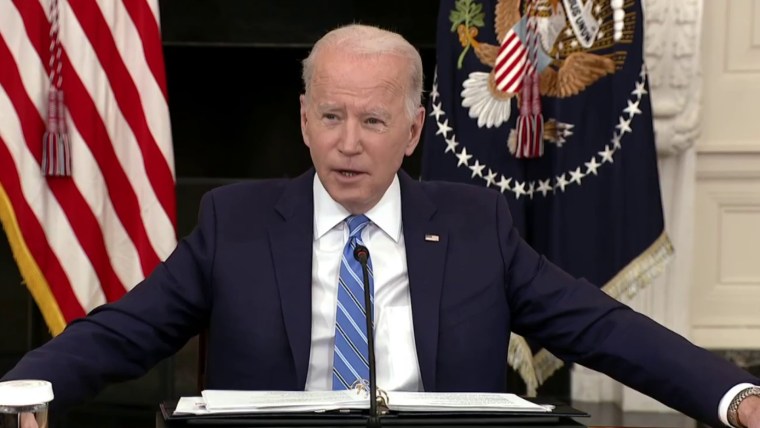

Joe Biden Thinks Congress Can Pass Part Of Build Back Better Act

Manchin Says Build Back Better Is Dead Here S What He Might Resurrect

Infographic Real Estate Is The Most Able Investment From Trang S Building Wealth In Real Estate Pr Real Estate Infographic Real Estate Postcards Investing

Biden S Big Social Spending Bill Probably Will Pass Senate This Month Without Many Cuts To It Analysts Say Marketwatch

What S In Joe Biden S Plan For Child Care And Elder Care Npr

Refinancing How Homeowners Can Save Money Or Cash Out Their Equity Homeowner Cash Out Being A Landlord

Https Www Forbes Com Sites Peterjreilly 2021 09 25 Time To Change Your Estate Planagain Estate Planning Estate Tax Grantor Trust

Us Treasury Pushes Back As Budget Office Warns Biden S Bill Will Swell Deficit As It Happened Us Politics The Guardian

Us Failure To Pass Build Back Better Act Imperils Rights Human Rights Watch

Biden Announces 2 Trillion Climate Plan The New York Times

Us Failure To Pass Build Back Better Act Imperils Rights Human Rights Watch

How To Avoid A Big Tax Penalty On Your Retirement Savings Cnbc Saving For Retirement Retirement Finances Money

Ag Policy Blog There S No Cow Tax In The Build Back Better Bill

Biden S Bill Funds Niche Items From Electric Bikes To Tree Equity The New York Times

How To Manage Your Money As A Couple In 9 Steps Managing Your Money Couples Money Management Couples Money

The Great Reset Conspiracy Flourishes Amid Continued Pandemic Anti Defamation League

Biden Budget Tax Plan Raises Tax Rates To Highest In Developed World

2020 Was The Right Time To Increase My Real Estate Portfolio By 1 Million Wealth Building Estate Tax Being A Landlord